That ATMs Setup which are, owned and operated by non-banks are called white label ATMs and are authorized under the Payment and Settlement Systems Act, 2007, by the RBI. Using these ATMs is similar to using an ATM of a bank other than the bank where you have your account. Currently there are eight white label operators in the country — AGS Transact Technologies, BTI Payments, Hitachi Payment Services, Muthoot Finance, RiddiSiddhi Bullions, SREI Infrastructure Finance, Tata Communications Payment Solutions, and Vakrangee. While debit card issuance increased rapidly in the last few years, the number of ATMs has not increased commensurately, creating a challenging situation for banks and inconvenience to customers

Why Indezon andHitachi Payment services Pvt Ltd?

Indezon Business Pvt Ltd signed agreement in Dec 2019 with Hitachi Payment services for acquisition for white label ATM machine. With a view to increase our customer satisfaction we offer various plans as per Hitachi Guidelines:

Hitachi ATM Machine

Under this model we offer White label ATM where only cash withdrawal is allowed with best services and commission in industry along with best life time maintenance option.

Hitachi CRM Machine

Cash Recycling Machines (CRM) is dual function advance ATM machines which accept cash deposits, process the notes and then use that for cash withdrawals. The benefit of deploying a cash recycler is enhanced efficiency both in terms of operations as well as costs. Cash recyclers are able to accept cash from customers and dispense as well. Machines are supported with Bill Validation Technology to ensure genuineness of currency. It is one of the new business option emerged in 2019 where currently few banks are allowed by NCPI in first phase to accept cash. Indezon in capacity of reseller provide this CRM Machine under various plans option and Investment.

1. How can I Apply white label ATM Machine Business?

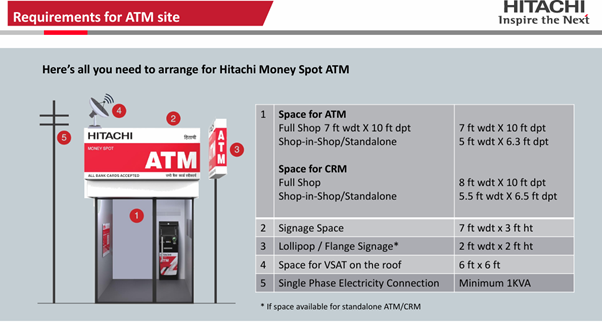

You should have 6ft*8ft=48 Square feet shop space and working Capital of more than 4 lakh to investand time to spend in daily ATM Operation.

2. What are other requirements for applying ATM Machine?

You should have nearby Bank Branch who can provide Daily cash and it should not be far more than 5km from ATM Location and your home should be not be more than 3km from ATM Location. We prefer serious candidate whose age is more than 25 years and entrepreneur skill.

3. Can I apply white label ATM anywhere I like?

No you should have good location where at least 100+ daily cash transaction can be done. You have to provide photograph and video of location, once site looks good we will visit for further verification. It should not be near to existing Hitachi ATM by 600 Meters and 300 meters for other bank ATM.

4. Can I apply in rented location?

You can apply but you should provide rent/lease agreement of minimum 3 years and into total 9 years of agreement period.

5. How much I earn from ATM Business?

Your monthly income is dependent upon daily transaction and plan you choose. Howeveryou have potential to earn more than 1 lakh per month.

6. What is agreement period and can I close if I don’t like in future?

Agreement period is 9 years and you can close by paying Rs.1 lakh as closure charges plus any other charges at the time of closure

7. What is difference between ATM and CRM Machine?

In ATM Machine Only Cash withdrawal facility is available and in CRM Machine both Cash withdrawal and Deposit is available in single machine and cash deposited is used for withdrawal. Only few banks are available for deposit currently.

8. Is all bank cards accepted in ATM and CRM machine?

All banks cards are accepted in Hitachi ATM machine as per RBI Policy and works same like bank brown Label ATM.

9. Can I shift ATM at any other location in future?

You can shift after 6 months by paying relocation charges. Currently we charge Rs.30000 + GST as relocation charges plus any other charges at the time relocation.

10. Can I change Ownership of ATM?

You can change ownership by providing No Objection certificate (NOC) from old owner and clear all dues before any Owner change.

11. Who will put cash in ATM?

Franchisee is responsible for daily cash loading in ATM Machine .We don’t provide any cash Van facility.

12. From where I will get daily cash?

You should have current account where daily settlement will be paid,You have to visit bank to get cash for ATM

13. Can I Put cash in ATM by collection from market?

No you have to withdraw cash by self-cheque from linked bank account and put equal cash in ATM.We take monthly bank statement to get this verified and issue TDS Certificate based on this.

14. Is there Cash withdrawalTax of 2 % after 1CR cash withdrawal?

Exemption from application of 2% TDS on Cash withdrawals U/s. 194 N of the Income Tax Act, 1961 (43 of 1961) to white label ATM Operators and its Cash Replenishment Agencies (“CRAs”) and Franchise Agents. Ref:

- 194 N of the Income Tax Act, 1961 (43 of 1961)

- Notification from Ministry of Finance, Department of Revenue dated September 18, 2019- Notification No. 68/2019/F. No. 370142/12/2019-TPL]

15. Are there any charges for ATM Installation?

Indezon does not charge any ATM Installation fees, brokerage for Installation. Indezon is not responsible if any applicant has paid any fees to any third party agent. Any payment made to Hitachi payment services Pvt Ltd account is only valid and legal.

16. What is the hardware given after approval?

Hitachi Provides ATM Machine/CRM Machine/V-Sat for Internet Connection /Inverter –UPS -Battery / Staplizer / Earthing material as per policy and do all required furnishing for ATM Functioning. No CCTV is provided.Francisee is advised to install at his own cost.

17. When is commission paid and how is settlement done for TXN?

Settlement is done next working day and commission is paid next month after bank statement and pendency is cleared by Franchisee.

18. Who will provide Day to day support?

Indezon will provide day to day support in form of coordination with Hitachi and franchisee. However final support rest with Hitachi Payment services and their vendor. Franchisee is supposed to follow LOI guidelines and agreement term and conditions in case of any dispute.

19. Who to contact for applying Hitachi ATM Machine and one stop solution for ATM Support.

You can call to our Customer care no for getting information about ATM proposal. Also you can call to 9811339311/9891128484 for any query and complaint. You can also write to our helpdesk mail id info@indezon.in